It’s that time of year again folks. Summer is gone, the leaves are turning, and we’ve already had our first frost here in Kansas City. If you got up early enough you could even see some snow falling a few days back. As this year comes to a close it has me thinking about what next year has in store for the refrigerant market, especially R-22.

As most of you know next year is the last hurrah for the HCFC R-22 refrigerant. This is due to the phase out coordinated by the Environmental Protection Agency. This phase out started back in 2010 by preventing any new appliances from using R-22. Then, as the years passed the import and production restrictions set in. The January 1st, 2020 date that is quickly approaching (Only fourteen months away) is the last straw. On this date there will be NO production or importation of R-22. That’s it. Finis.

What that means is there will only be two future sources of R-22 refrigerant for consumers. The first is the backlog of inventory on the market. This is all the inventory that companies bought up on in prediction of this looming 2020 deadline. The other source is whats known as refrigerant reclamation. I won’t get into it too much here but reclamation is taking previously used dirty R-22 refrigerant and putting it through a certified refurbishing process. I’m an automotive guy and I see this reclaimed R-22 just like I see a remanufactured part. You get that savings, but you also get that understanding that it was previously used in a different application. Personally, I have no problem with buying reman or buying reclaimed refrigerant. If it goes through a certified EPA process, what’s the worry?

Now, there is a third option out there that a lot of you may already be familiar with. Alternatives to R-22. There is a whole market out there dedicated to alternative refrigerants for R-22 applications. They could be a drop-in replacement or it could be retrofit. The point of these refrigerants is to give consumers a choice, and a lot of times save the customer money. There were times where the price of R-22 went through the roof and alternatives began to take off. But now that the price has begun to crash the alternative market has begun to shrink as well.

Past & Present

To fully understand the R-22 market and what we predict it will do next year we first have to look at the past and the present. No, this isn’t a Charles Dickens novel. Along with the 2010 and 2020 dates another big part of the R-22 phase out occurred in 2015. This is where production and import limits were shrunk. This sudden loss of supply caused the price to climb and climb. In the summer of 2017 the price had gone over seven-hundred dollars for a thirty pound cylinder. Seven-hundred dollars. That’s twenty-three dollars a pound.

Over these years companies and investors watched the price of R-22 go up and up. Some of the lucky ones bought up in 2014 and 2015 and held onto it when that high price hit. Others thought that the price was going to keep going higher. So, they bought. They bought with the hope of the price reaching eight-hundred, nine-hundred, maybe even over a thousand a cylinder. This wasn’t unheard of. Back in the 1990’s when R-12 was phased out there were times where it did reach one-thousand a cylinder. (Nowadays it’s about six-hundred a cylinder.) The problem is that this buy up was a gamble. No one truly knew what was going to happen. Would the price continue to climb as it did in 2016 and 2017? Or, would it began to settle back down and level off?

2018

What actually happened in 2018 was quite unexpected. Many people thought the price would go down and level off, but no one predicted that the price was going to be cut in half. Yes, in half. The price for R-22 in 2018 was slashed by fifty percent. That seven-hundred dollar price is now three-hundred and fifty. Actually, it’s even lower then that. Depending on how much you buy you could get cylinders for as low as three-hundred and twenty-five dollars.

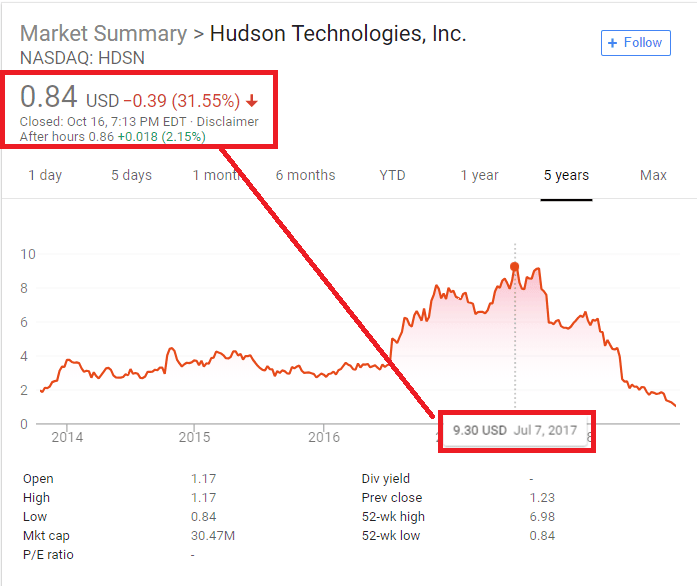

While contractors and consumers were rejoicing at this price drop there were many distributors panicking. Those guys who thought they were making a good gamble back in 2016 and 2017 are now stuck with a high priced product in a low priced market. One extreme example of this is Hudson Technologies. Hudson is a refrigerant distribution company based out of New York and they bought up A LOT of R-22 refrigerant during 2016-2017.

The graphic below is from Google but it provides a great illustration of the rise and fall of R-22 pricing. At the peak of R-22 pricing in summer of 2017 we saw a stock price of $9.30. Now, a little over a year later and with the price of R-22 more then cut in half we now see a stock price of $0.84. That is a HUGE drop. On top of the stock value loss Hudson also wrote off fourteen million dollars of R-22 inventory in their second quarter. Keep in mind too that the fourteen million is NOT all of their R-22 inventory. No, that is a cost adjustment so that they can be more competitive in the market place.

The Why?

Before writing this article I talked to a few leaders in the refrigerant industry to get their thoughts on what exactly happened here. The consensus that I received was that R-22 has a price ceiling. There is only so high it can go. If it goes above that point, like it did in 2017, then the lower priced alternative refrigerants began to take over the market.

If you think about it it makes perfect sense. Would you buy a generic product if the brand name was right about the same price? Of course not. But, if that brand kept going up and up in price then that generic product begins to look more and more appealing. Along with the price going too high for R-22 due to speculation and over purchasing by distributors we also have to consider that the number of R-22 alternatives on the market today have exploded. I won’t list them all here but a few of the most popular ones are Chemour’s MO99 and Bluon’s XTD-20. Along with the amount of choices out there these alternative suppliers have also made it easy by offering drop-in or near drop-in replacement products.

The good news though for your R-22 investors is that as the price of R-22 goes back down the demand for alternatives will began to erode. It’s a balancing act that a lot of folks found out the hard way.

2019 Considerations & Prediction

Ok folks, so now we’ve gone through what’s happened over the past few years when it comes to R-22. Now it’s time to take a look at what considerations I will be taking into account for my prediction for 2019. In my day job I am a software analyst. I look at the details of a program or problem and figure it out through careful analysis. I love digging into the details like that. I take the same approach here when it comes to my prediction.

My predicted price for R-22 next year is based off of these specific considerations:

- The price was cut by fifty percent this year and many people say that it can’t go lower.

- The ‘newest’ R-22 machine is from 2010 or earlier. So, that puts the machine at nearly nine years old. A typical home’s air conditioner lasts between ten to fifteen years. Some of these R-22 will start to be replaced with R-410A. This will shrink demand and lower price.

- When we hit 2019 there will be less then a year before total phase out of R-22 begins. This could drive price higher due to people wanting to buy before the cut-off.

- In my opinion the market is saturated. Too many people have bought too much R-22 and now with this price drop they are just trying to offload, take the write-off, and be done. This can keep prices low.

- There is a refrigerant reclamation industry but I honestly don’t see this having much impact until at least 2021 or 2022. Unfortunately, most folks won’t go the reclamation route until it’s a last resort and with the over supply of R-22 on the market I don’t see reclamation making much of a dent.

- The last factor is the alternative refrigerants. As I mentioned above these refrigerants are in a careful balancing act with the price of R-22. If R-22 goes too high then the alternatives take over and cause the R-22 price to shrink back down. I foresee these alternatives contributing to a lower R-22 price.

Prediction

From my conversations within the industry it seems to be that the ‘sweet spot’ for R-22 is right under five-hundred dollars a thirty pound cylinder. That price allows consumers to still purchase the refrigerant without everyone running towards the cheaper alternatives. If that five-hundred target doesn’t happen then I have seen others state that between four-hundred and four-hundred and fifty a cylinder is enough to deter alternatives and still make a profit. This price is what the distributors want, but what will actually happen?

As far as what will occur next year, it’s tough to say. My prediction is that we will see this very low price of around three-hundred and thirty a cylinder maintain throughout the winter months of 2018/2019. Then, as we inch closer to spring I expect to see a slow uptick in pricing. When we get into spring, say April or May, we could see R-22 prices at around three-hundred and sixty to three-hundred and seventy-five dollars a cylinder.

Moving into summer I could see prices climb upwards to four-hundred dollars. The absolute highest I see is four-hundred and twenty-five a cylinder and that would be at the peak of summer. As summer wanes and the fall begins to set in I could see price of R-22 maintaining right around that four-hundred to four-hundred and twenty-five dollar price. This price will continue onwards until we hit that January 1st, 2020 deadline. From here it’s hard to say. Will the price stay flat, or will it rise slightly? Time will tell.

Conclusion

I want to take the time here in this conclusion to state that this article is a prediction. It is by no means an indicator on what will happen in the industry. This is one person’s opinion, but I hope that it was able to help you forecast for next year.

Please note that RefrigerantHQ or myself are not liable for any investment losses or earnings from R-22 refrigerant based off of this article.